Real Estate Prices in the United States vs Cabo

Real Estate in the United States vs Real Estate in Cabo

Lately, I’ve heard people say that housing prices in Cabo are expensive—and I’d agree. I’ve lived in Cabo for nearly a decade, and prices have only gone up. But take a step back and look around the world: what market hasn’t gone up? The stock market, the cost of living—they’ve all increased globally.

Many of our buyers are from the United States, and I often hear them say real estate in Cabo is getting expensive. Fair enough. But my question is: what’s happening in your market back home? Because chances are, it’s not looking great either.

Recently, I had a prospective buyer from the Seattle area. On our first call, she told me she was giving her son his inheritance early so he could buy a home in the U.S. Her words stuck with me: “He did everything right—went to school, got good grades, graduated college, got a job—and at 27, he still feels hopeless when it comes to buying a home.”

This isn’t an exception—it’s the norm in the U.S. today. The previous generation could afford to buy a home in their mid-20s. But income levels simply haven’t kept pace with rising home prices. I honestly can’t think of a single U.S. market that’s a screaming deal right now. Prices are up across the board—compared to 5 or 10 years ago, everything is more expensive. And don’t even get me started on insurance and taxes.

According to Insurify, the average U.S. homeowner’s insurance premium in 2025 is $3,520—an 8% increase from 2024. Coastal states like Florida and Louisiana are leading the surge due to flood and hurricane risks, while California is seeing premiums rise because of wildfires and other natural disasters. As homeowners and legislators push back, many insurance companies are just walking away from those markets altogether. That leaves fewer providers, less competition, and higher costs.

Here’s a quote from an email I received in May that says it all:

“I will soon list my vacation home in Fort Lauderdale, due to the neighborhood flooding twice in the last three years (20 inches of rain each time—neither was from a hurricane). The home itself didn’t flood, but now it’s nearly impossible to get insurance. The cheapest home/flood quote was $30,000—and that’s after I spend $40,000 to replace a 10-year-old roof.”

That sums it up. Insurance costs are spiraling, and almost every U.S. homeowner is feeling it. This isn’t a short-term problem—it’s a structural issue that will continue to erode affordability.

And that’s just one piece of the puzzle. According to Bankrate.com, the average U.S. property tax in 2025 is a staggering $2,459 per year. Combine that with the average annual home insurance cost, and you’re looking at over $6,000 per year in just insurance and taxes. This affects not only homeowners but also landlords and investors trying to renovate or revive vacant properties. And we haven’t even touched mortgage payments yet.

According to BusinessInsider.com, the average mortgage payment in 2025 is:

$2,715/month on a 30-year fixed mortgage

$3,552/month on a 15-year fixed mortgage

Meanwhile, the Mortgage Bankers Association reports the median mortgage payment in 2025 is $2,617/month.

That brings the total monthly burden to over $8,600/month for many U.S. homeowners—before you even factor in utilities, HOA dues, or general property maintenance.

As of today, the average 30-year mortgage rate is 6.72%. There’s mounting political pressure to lower rates, but it’s worth remembering that just a few years ago, in 2021, rates dropped below 3%. Buyers jumped in, locking in ultra-low rates, and home prices surged. Since then, while prices have plateaued or even ticked up slightly, mortgage rates have more than doubled—leaving many homeowners with no incentive to sell and jump into a higher-rate mortgage. This “lock-in effect” has kept inventory low and transaction volume down for the past couple of years.

The U.S. economy, and its housing market in particular, is stuck between a rock and a hard place. National debt has surged to 120% of GDP—now topping $36 trillion. Debt service alone now costs the federal government $800 billion per year, second only to Social Security.

And speaking of Social Security, that’s another hot-button issue, as an aging population and the daily retirement of thousands of baby boomers add mounting pressure to the system.

Yes, the Federal Reserve could lower interest rates to stimulate the market and inflate asset prices again—but it would also worsen long-term debt obligations, which already consume a huge share of government spending. Add in the political gridlock in Washington, and the outlook becomes even murkier. These days, it seems politicians are more interested in blaming each other than finding solutions.

So, is the U.S. becoming a nation of renters?

If so, that doesn’t paint a particularly optimistic picture either. The "American Dream" of homeownership now feels more like a dream you have while sleeping than a reality for millions of Americans. Meanwhile, institutional investors and hedge funds continue buying up housing stock—everything from single-family homes to entire apartment complexes—making it even harder for the average family to compete.

What about new construction—materials, labor, and development? Unfortunately, that’s not looking too promising either. The new home market in the U.S. is dominated by a handful of large national builders, many of whom are discounting inventory in select markets just to maintain volume.

Small, independent builders? Good luck competing with that scale—and at those prices.

Labor shortages are another major concern. Who's going to rebuild cities like Los Angeles after the next round of wildfires? Historically, much of that labor has come from Latin American immigrant workers. Today? That supply chain is far less predictable. What is predictable is that the cost to build will only continue to rise, making it even more difficult to solve the housing crisis through new development.

We’re not going to build our way out of this. The problem is structural, and far more complex than simply adding inventory - especially affordable inventory.

And what about the Baby Boomers—Da Boomas—often referred to as America’s “greatest generation”?

Yes, the same generation leaving behind a debt-to-GDP ratio larger than anyone could have imagined. They’re retiring by the millions. The median age in the U.S. is now 38.7—nearly a full decade older than Mexico, for comparison. Younger families are having fewer children, in part, I believe, due to the skyrocketing cost of raising them.

U.S. population growth has been declining for decades—currently around 0.5% annually, which is roughly half the rate of Mexico. Immigration has historically fueled U.S. growth, but in today’s political climate, it’s increasingly constrained. Now, the government is resorting to offering tax incentives to encourage more births—efforts that, so far, feel like too little, too late.

An aging population is one major piece of this complex puzzle. Boomers will pass down wealth, and some of that will help younger generations with down payments—but homeownership today feels more like a team effort. Many younger buyers simply can’t afford to buy without help from parents or grandparents.

Do I blame Boomers? Absolutely not. But I also don’t think it’s fair to blame Millennials or Gen Z either. Every older generation tends to criticize the younger one—it's as old as time. But today’s younger generation is entering adulthood with record levels of student debt, often earning degrees that feel equivalent to what used to be a high school diploma.

Sure, some will break out and build great careers, just like in generations past. But the path is steeper now. The numbers speak for themselves: the average age of a first-time homebuyer in the U.S. is now 38. Back in the 1980s, it was nearly a decade younger.

So where does that leave us?

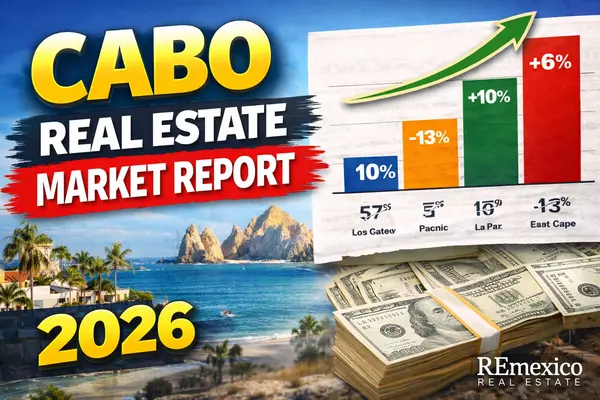

Prices are high—everywhere. The stock market is near all-time highs as I write this. Yes, Cabo and other parts of Mexico have seen price increases. But if you zoom out and compare the full picture, one could argue the housing crisis in the U.S. is even more dire.

As the saying goes: “Don’t throw stones if you live in a glass house.”

Fletcher Wheaton

fletcher@remexico.com

Categories

Recent Posts

GET MORE INFORMATION