US Real Estate vs Cabo Real Estate Market

The U.S. Real Estate Affordability Problem in One Chart

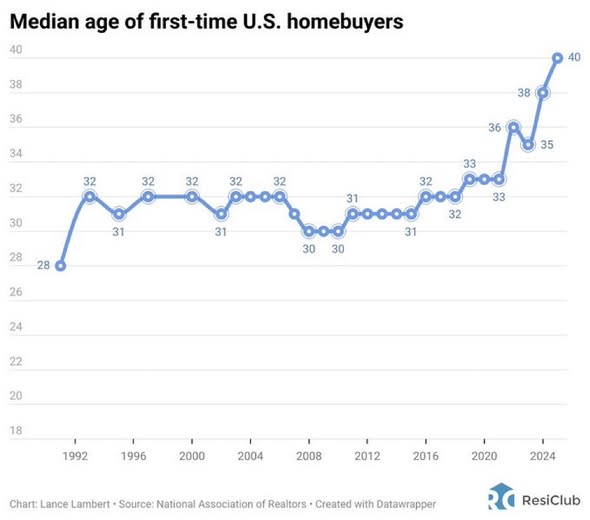

At the Resi Club conference in Manhattan, one slide really stuck with me:

- 1992: Average age of a first-time homebuyer in the U.S. = 28

- 2025: Average age of a first-time homebuyer in the U.S. = 40

That’s an enormous shift.

Forty is not “just starting out” anymore. By 40:

- You can easily have kids in double digits age.

- Your peak earning years might be underway—but so are higher expenses.

- You’ve already spent a decade or more renting or moving sideways instead of building equity.

Add to that:

- Housing is more expensive.

- Insurance is more expensive.

- Healthcare is more expensive.

- Almost everything in life costs more.

So when someone says, “Cabo is expensive,” the fair response is:

“Show me one real estate market that isn’t expensive right now.” Sure some areas of the Cabo real estate market are more expensive than they used to be, but there is still plenty of opportunity and the sales numbers speak for themselves.

The 50–Year Mortgage: More Payment, Not More Affordability

One of the headliners at the conference was Bill Pulte, and one of the big topics was the rollout of the 50-year mortgage.

On paper, the sales pitch is simple:

“Stretch the term, lower the payment.”

But when you look at the math on a $500,000 home:

- Over 50 years, total interest paid can be close to $1.4 million.

- You’re paying roughly 3x the price of the home in interest alone.

It’s classic U.S. financing logic:

- Focus the conversation on monthly payment (“It’s only X per month!”).

- Distract from the total cost over the life of the loan.

What’s wild is that the average American homeowner only owns a home 12–13 years before selling or refinancing. Most people never get close to paying off a 30-year mortgage, let alone a 50-year one. They just keep swapping debt.

So does a 50-year mortgage solve affordability?

- It might let some people qualify on paper.

- It might help investors lever up further.

- But it doesn’t solve structural affordability – and it arguably makes the long-term picture worse.

Insurance: The Silent Killer of Affordability

One of the more under-discussed issues in the U.S. is insurance.

Historically, insurance costs grew at a certain baseline pace. Now, depending on the market, they’re rising:

~3x faster than they used to.

Why?

- Higher rebuild costs (labor, materials, permits).

- People moving into higher-risk areas (coastal, wildfire zones, flood plains).

- Insurers pulling out of certain states, reducing competition.

Example from the conference:

- A friend in New Orleans with a good engineering job:

- Homeowners insurance went from $2,000/year

- To about $7,500/year

- In roughly four years

- And the number of insurance providers dropped from around 15 to 4.

When you layer that on top of higher rates and higher prices, you’re no longer just talking about the price of the home—you’re talking about the total carrying cost of the “American Dream.”

Who Actually Qualifies for a Mortgage Now?

Another big point: the role of subprime and private-label mortgages in the 2000s.

Before 2008:

- Roughly one-third of the mortgage market consisted of more flexible, higher-risk loans.

- That entire slice mostly vanished after the financial crisis—and it hasn’t come back.

The impact:

- A huge chunk of people who used to squeak into homeownership now can’t get a mortgage at all.

- Many of them are excellent rent payers, but their credit profiles don’t pass modern underwriting.

One investor speaking at the conference said:

- Drop your credit score from 740 to 640?

- You might only need to miss two payments.

- To climb back from 640 to 740?

- It might take five years of perfect behavior.

During the pandemic, even with eviction moratoriums:

- 94% of his tenants kept paying rent.

- Many of those people still cannot qualify for a mortgage.

A few other sobering stats:

- Only about 25% of U.S. households qualify for a mortgage today.

- Around 60% of households cannot afford a $300,000 home, and the average U.S. home is already north of that.

So when people talk about “fixing affordability” with creative mortgage products, the problem is deeper than the term length.

Are Investors “Stealing” All the Homes?

There’s a popular narrative that “Wall Street” is buying up all the single-family homes and shutting out first-time buyers.

The investor at the conference pushed back with some data:

- 90% of investor-owned homes are held by small landlords with fewer than 11 properties.

- So-called “mega investors” (1,000+ homes) are around 2.1% of the total.

At the same time:

- Investor share of purchases hit 33% of all home buys in Q2 2025.

So both things can be true:

- It’s not just a handful of giant firms owning everything.

- But one-third of all purchases being investor-driven is a huge deal for first-time buyers trying to compete.

If you then introduce 50-year mortgages and other tools that investors can access easily, it’s not obvious that affordability for end-users improves.

Domestic Migration, “Halfbacks,” and Why People Are Leaving

The conference also dug into domestic migration inside the U.S.:

- Watching flows like New York → Florida is critical because it’s often high-income households making these moves.

- People at the bottom of the income spectrum don’t usually have the flexibility to just pick up and relocate states.

Now we’re seeing a new pattern:

New York → Florida → Carolinas

Some call them “halfbacks”:

- They left New York for Florida (taxes, weather, politics).

- They realized Florida comes with heat, humidity, sky-high insurance, and sometimes more risk than they signed up for.

- They move “halfway back” to North or South Carolina—often keeping better weather and lower costs than the Northeast, but less intensity than Florida.

And then you have another trend: Americans leaving altogether.

- Cabo, other parts of Mexico, Portugal, etc.

- Families moving full-time with kids for lifestyle, cost, and frankly mental health reasons:

- Less political drama.

- Less 24/7 news anxiety.

- A different pace of life.

Builders, Incentives, and Why “Just Build More Homes” Isn’t Simple

A common argument is:

“Housing is unaffordable, so we just need to build more homes.”

On one level, that’s true—supply matters.

But large public builders like Lennar are dealing with their own realities:

- Profit margins compressed from roughly 30% to ~17% in recent years.

- They’ve dramatically increased incentives:

- Buying down interest rates for buyers.

- Throwing in upgrades, concessions, etc.

- The conference cited around 14% more incentives now than a couple of years ago.

At the same time:

- Many of these builders own huge land banks.

- They’ll sit on lots when the environment isn’t ideal:

- “Why build now if we already have inventory and we can wait for better pricing?”

- So you have a national “housing crisis,” but the supply side is answering to shareholders, not policymakers.

So What Does All This Mean for Cabo?

When you zoom out, a few themes connect the U.S. and Cabo markets:

- Wealthy buyers are still very active.

- They can move, they can rotate out of stocks, they can buy second homes.

- Many look at the U.S. political and economic noise and think, “I want a place in Cabo.”

- The stock market feels “top-heavy.”

- A small group of companies driving a huge share of earnings.

- If you’re sitting on large equity gains, there’s a strong argument for rotating into hard assets:

- Real estate (U.S. or abroad)

- Gold

- Even crypto and Bitcoin for some people.

- Cabo is on that shopping list for lifestyle buyers.

- Cabo still has micro-markets.

- High-end: Chileno, St. Regis, Park Hyatt, ultra-luxury resales = very strong.

- Mid-range: Tezal condos, certain submarkets with lots of similar product = buyer’s market.

- Land: everything from $50K lots to massive development parcels.

- Leverage is limited here.

- Less systemic risk from weird mortgage products.

- Fewer forced sellers.

- Market can get soft or segmented, but you’re not seeing the foreclosure wave or “must sell in 90 days” distress you see in some U.S. cycles.

Fletcher Wheaton - fletcher@remexico.com

Categories

Recent Posts

GET MORE INFORMATION